All Things Home & Auto Insurance

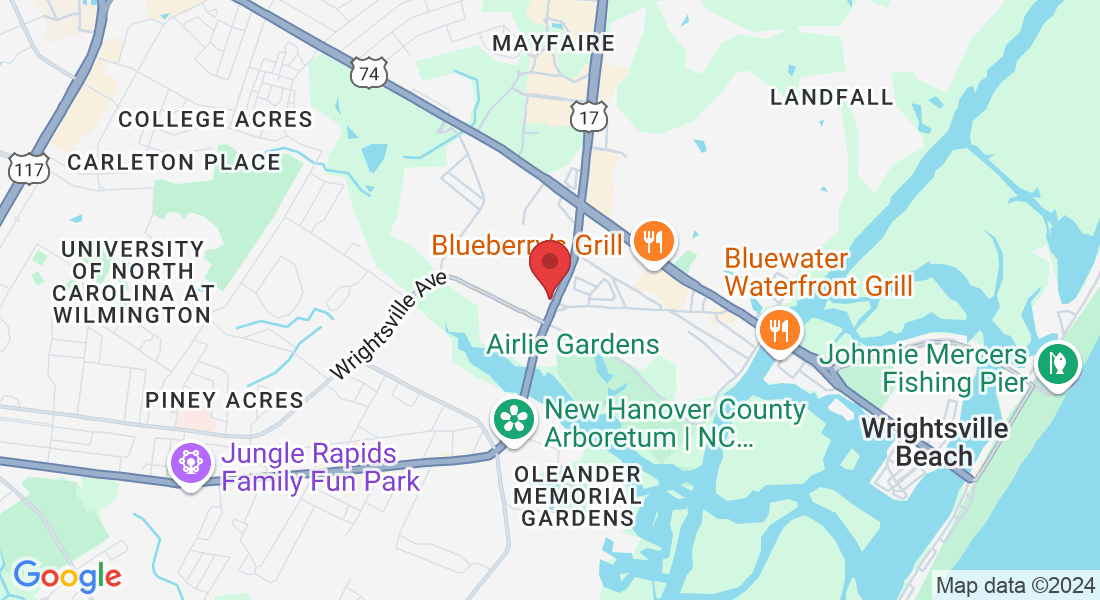

We are a locally owned independent insurance agency based in Wilmington, NC. Our goal is to provide the best insurance solutions to our clients, which is why we have established partnerships with some of the leading insurance companies in the country. By collaborating with these organizations, we are able to offer a wide range of options and find the most suitable coverage for your needs.

Client-Centric Excellence: Elevating Your Insurance Experience

About us

Our commitment to exceptional customer service drives us to prioritize effective communication and transparency. We believe in keeping our clients informed and empowered throughout the insurance process. Our team takes immense pride in our ability to deliver comprehensive coverage at affordable prices. Trust us to protect what matters most to you.

What We Offer

Auto Insurance

Your vehicle is more than just a mode of transportation—it's an essential part of your daily life. That's why we're dedicated to providing reliable auto insurance coverage to keep you protected on the road.

Home Insurance

Living on the North Carolina coast comes with its unique charm and beauty, but it also presents specific insurance challenges.

At All Things Home & Auto, we understand the importance of securing comprehensive insurance coverage tailored to the needs of coastal homeowners.

Business Insurance

Running a business comes with its share of risks, but with the right insurance coverage, you can safeguard your investment and focus on what matters most—growing your business.

Don't leave the future of your business to chance— contact us today to learn more about our business insurance solutions and get a personalized quote.

FAQS

What does homeowners insurance typically cover?

Homeowners insurance typically covers a range of risks and liabilities. It generally includes coverage for damage to your dwelling, other structures on your property (like a detached garage), personal belongings, liability protection in case someone is injured on your property, and additional living expenses if your home becomes uninhabitable due to a covered event. However, specific coverage can vary depending on your policy, so it's essential to review your policy documents and discuss your needs with your insurance agent to ensure you have the right coverage for your situation.

Can I make changes to my homeowners insurance policy mid-term?

Yes, you can usually make changes to your homeowners insurance policy mid-term. Common mid-term changes include updating your coverage limits, adding or removing endorsements, and changing your deductible. However, it's essential to contact your insurance provider to discuss any changes and understand how they might affect your premium. Keep in mind that certain changes may require underwriting approval, and some could result in adjustments to your policy premium.

What factors affect my auto insurance premiums?

Several factors influence auto insurance premiums, including your age, gender, driving record, type of vehicle, location, credit score, coverage limits, deductibles, and any discounts you may qualify for.

What is liability coverage, and why do I need it?

Liability coverage helps pay for damages and injuries you may cause to others in an accident for which you are at fault. It is required by law in most states and is essential for protecting your assets in case of a lawsuit. Fun Fact, North Carolina will be increase the minimum Liability limits starting

January 01, 2025